科利布里

Kolibri 是一种基于 Tezos 的稳定币,它使用抵押债务头寸 (CDP),称为“烤箱”,来维持与美元稳定价值资产 kUSD 的软挂钩。

Kolibri 是一种基于 Tezos 的稳定币,它使用抵押债务头寸 (CDP),称为“烤箱”,来维持与美元稳定价值资产 kUSD 的软挂钩。

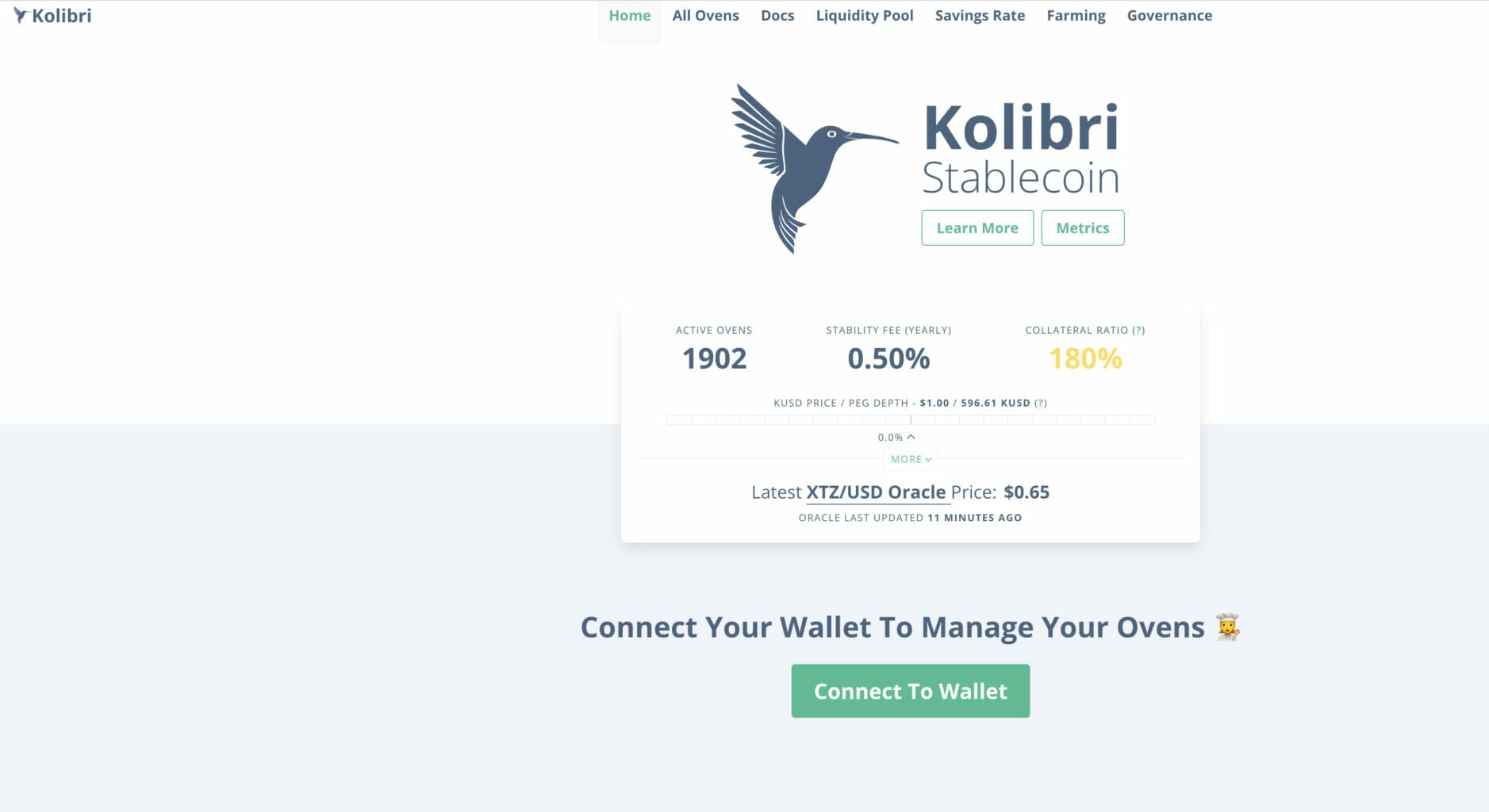

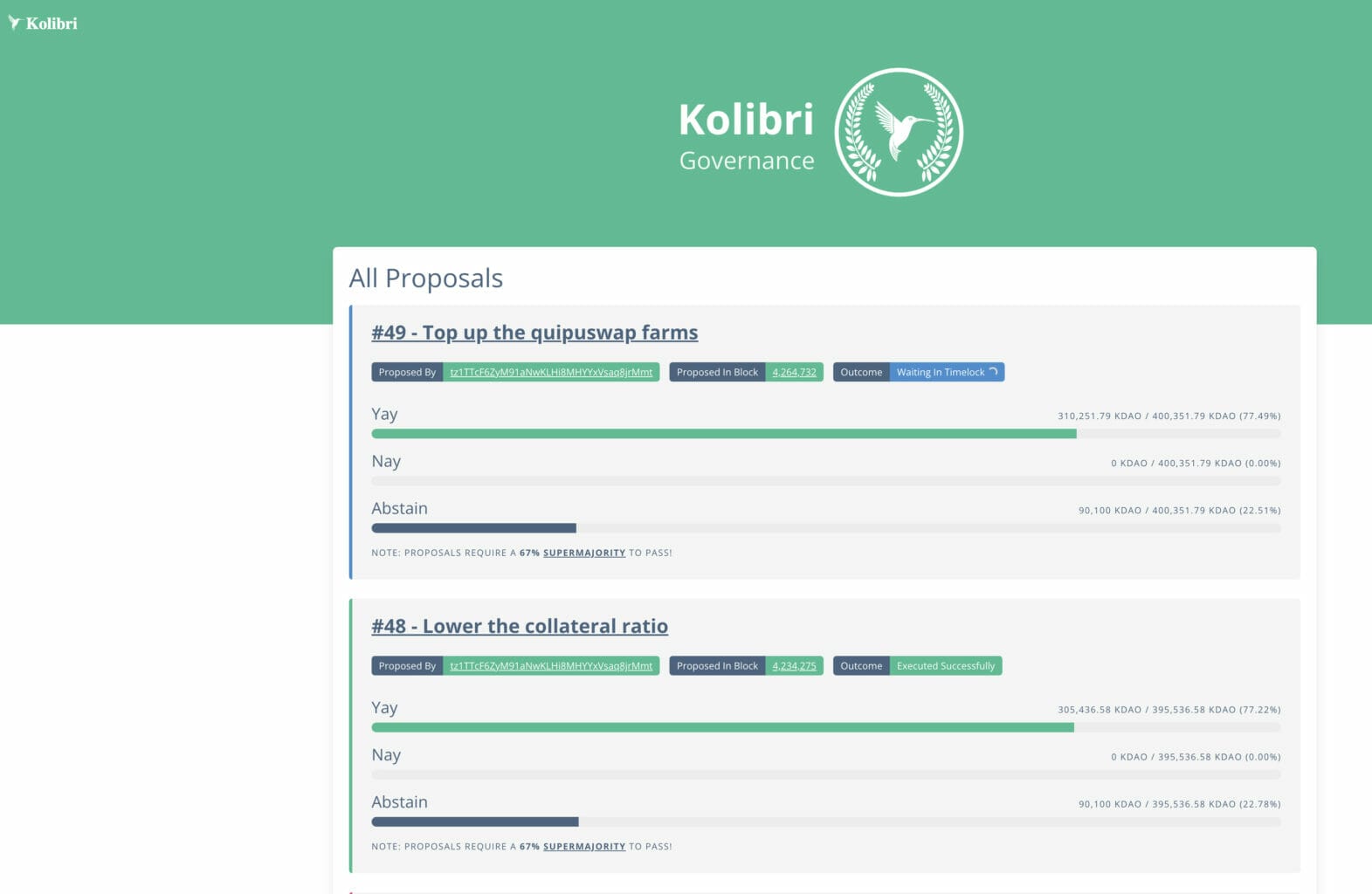

Kolibri is a Tezos-based stablecoin that uses Collateralized Debt Positions (CDPs), referred to as “Ovens,” to maintain a soft-pegged USD-stable value asset, kUSD. Users can deposit XTZ into an Oven and borrow kUSD against it, while also having the ability to withdraw or repay at any time. The system calculates a stability fee on borrowed kUSD, which is adjusted via governance to influence borrowing and repayment behaviors. To ensure solvency, each Oven must maintain a minimum collateralization ratio, which is rigorously calculated based on the XTZ deposited, the price of XTZ/USD, borrowed kUSD, and the stability fees accrued. In cases where an Oven falls below the collateralization ratio, a liquidation process is initiated to restore stability to the system.

Kolibri maintains a constant called the stability fee, calculated on a 60-second basis, and utilizes a linear approximation for interest calculation. The project operates with an Interest Index for each Oven, which is used to determine the interest each Oven has accrued, ensuring a seamless calculation process even in a system like Tezos. This Interest Index is adjusted with every interaction with the Minter, ensuring an up-to-date and accurate reflection of the interest accrued. The system receives accurate data from the Harbinger Price Feed via an Oracle contract, which can be replaced if needed, ensuring the flexibility and reliability of the data used for calculations.

In order to handle exceptional situations, Kolibri has established stability and developer funds. The stability fund acts as a liquidator of last resort, ensuring that the system can restore collateralization even in the event of a significant downturn, while the developer fund is used to finance future developments of Kolibri. The project is also dedicated to maintaining the peg of the kUSD token, with economic policies in place to ensure that 1 kUSD remains roughly equal to $1, providing a stable and reliable digital asset in the fluctuating cryptocurrency market.

Kolibri

Kolibri is a Tezos-based stablecoin leveraging Collateralized Debt Positions (CDPs), known as Ovens, to uphold a soft-pegged USD-stable asset, kUSD. Utilizing the Harbinger Price Feed, users can deposit or withdraw XTZ, borrow kUSD, and repay their borrowed amount. Each Oven must maintain a minimum collateralization ratio to remain solvent, preventing users from borrowing excessive kUSD and ensuring system stability. The stability fee, adjusted via governance, is applied to borrowed kUSD, helping in maintaining the peg to the USD. In case of under collateralization, a liquidation process is triggered to reinstate system stability. The project aims to sustain a consistent value for kUSD, equivalent to one USD, while automatically accounting for XTZ price fluctuations.

Key Features:

Oven Functions:

Deposit and withdraw XTZ.

Borrow and repay kUSD.

Stability Fee:

Accrued in kUSD terms.

Assessed every minute.

Adjusted via governance for incentive balance.

Collateralization Ratio:

Essential for Oven solvency.

Governed by XTZ value, borrowed kUSD, and stability fees.

Interest Calculation:

Linear approximation used.

Global and individual Oven interest indices maintained.

Oracle Contract:

Utilizes Harbinger Price Feed.

Ensures accurate and reliable data for operation.

Funds:

Stability and developer funds for system and future development support.

The Peg:

Aims for 1 kUSD to always equal $1.

Self-correcting mechanism for underlying XTZ price fluctuations.

Peg Depth:

Provides market liquidity insight.

Additional Information:

Kolibri also incorporates an Interest Index, updated with every interaction with the Minter, ensuring accurate interest calculation. The developer and stability funds help in mitigating risks and funding future developments, while the Oracle contract guarantees precise data for transactions and stability fee adjustments. Furthermore, the system continuously strives to keep the kUSD value at par with $1, employing various economic strategies to offset market variables and sustain the “soft peg.” The Harbinger Price Feed further fortifies the system’s reliability, inspired by Compound’s Open Price Feed, offering signed, dependable price data for seamless operations.

Kolibri is made by Hover Labs. Creator of decentralized products, infrastructure and services.

Submit your Tezos project to XTZ.news to have your project featured on the website. We only allow projects to be submitted that are presently interacting with the Tezos ecosystem.

Submit a Project您在 Tezos 上用于资产创建和管理的工具。去中心化、非托管、自治。

下一代Tezos DEX聚合器。 在一次掉期中来自最流行的 Tezos DEX 的流动性。 最优惠的价格和低滑点。 由 Baking Bad 打造。

Crunchy Network 代表了 Tezos DeFi 的一站式解决方案,并拥有一整套可用的 DeFi 应用程序和功能,包括 Crnchy 代币、Tezos 代币跟踪器、DeFi 钱包、流动性挖矿、DEX 聚合、Deep freezers(流动性储物柜)和未来的 sliced.art 平台。