尤维斯

您在 Tezos 上用于资产创建和管理的工具。去中心化、非托管、自治。

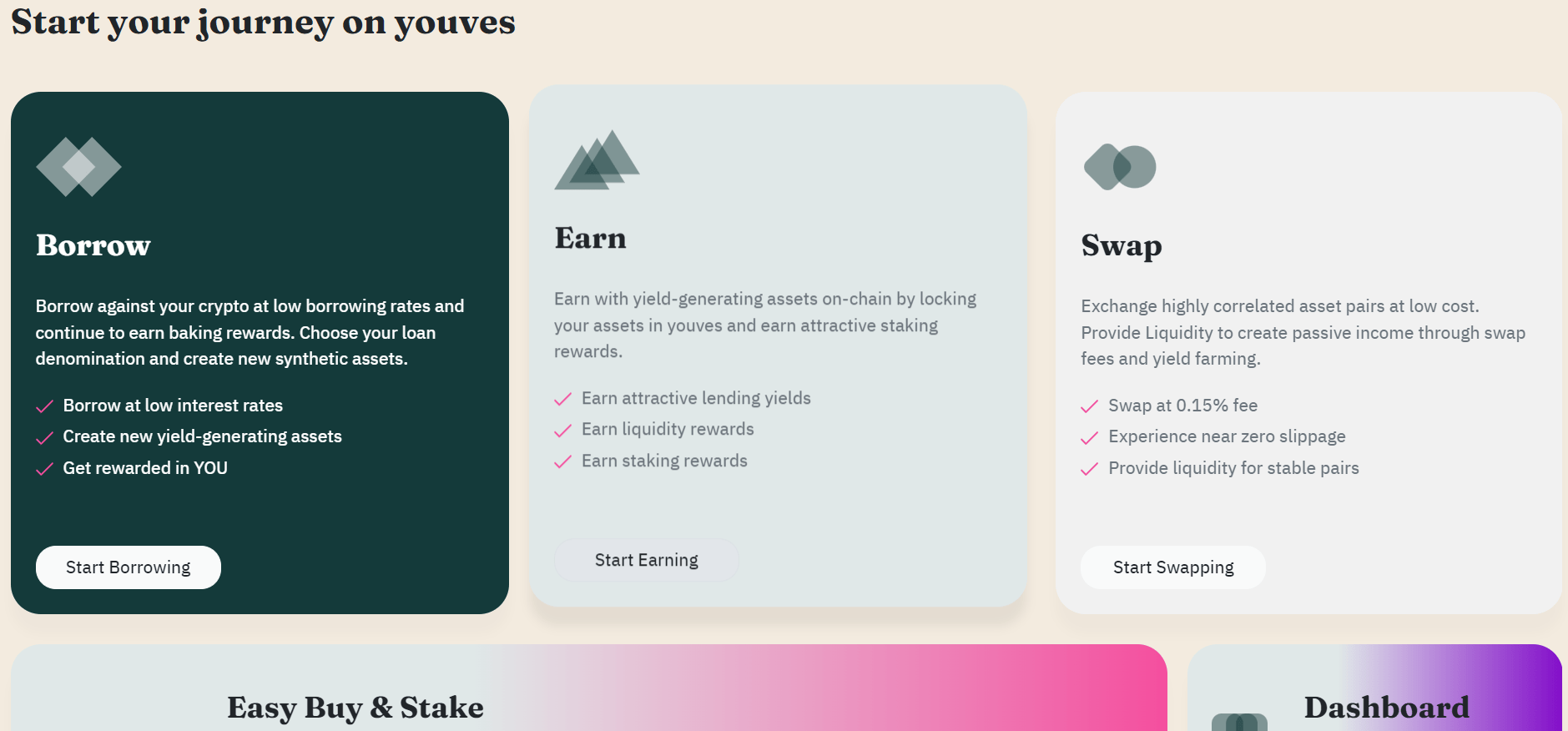

Borrow, Earn or Swap on youves.

Borrow against your crypto at low borrowing rates and continue to earn

free YOU tokens as incentives for minting and also get baking rewards

on your tez collateral. Choose your loan denomination and create new

synthetic assets like uUSD or uBTC or uXTZ or uXAU.

Earn with yield-generating assets on-chain. Lock your assets in the

youves pools and earn yields from platform revenues.

Swap highly correlated asset pairs at low slippage. Provide liquidity to

create passive income through swap fees and yield farming.

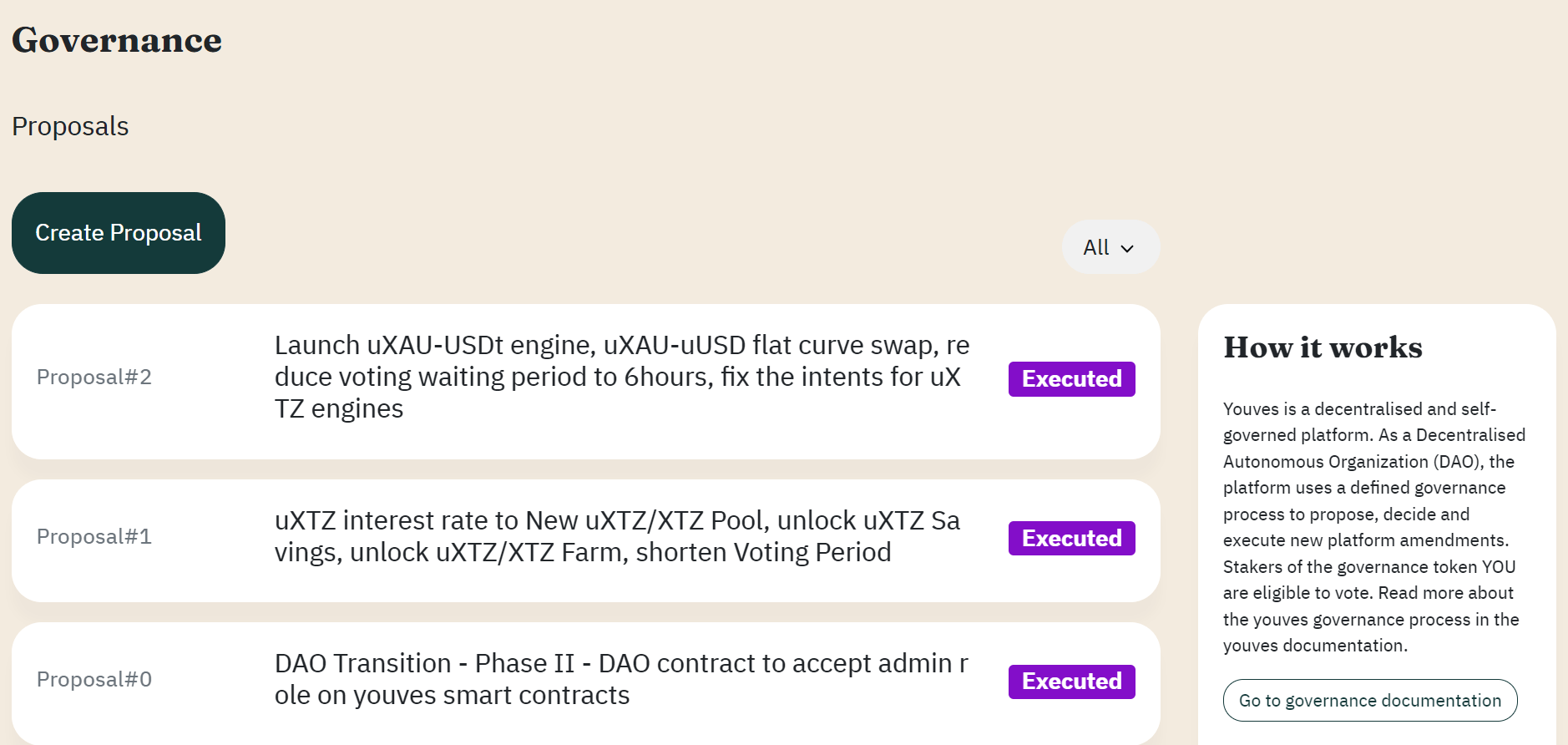

GOVERNANCE:

Make your voice heard by actively participating in the youves DAO

proposals and voting on YIPs.

Borrow (Mint):

With the collateralized lending mechanism on youves, users can create (mint) the stable token uUSD by locking up crypto collateral.

Minted tokens can be sold against other cryptocurrencies and/or fiat currencies to either create leverage or a fiat loan respectively.

There is a liability interest rate applied to the outstanding amount.

To withdraw the full amount of the provided collateral, minters have to burn (pay back) the minted amount plus any accrued interest.

The minimum collateral level (or maximum LTV) depends on the collateral type.

Minters must make sure the collateral level never falls below the minimum level, otherwise they risk being liquidated.

Minters are incentivised with YOU governance tokens.

Earn – Save & Stake

Holders of uUSD can diversify their crypto-asset exposure without having to access FIAT directly.

Holders of uUSD can earn an interest rate (paid by the minters) by putting them into the savings pool.

The entirety of liability interest rates minus the platform profit of 1% is distributed to the savings pool, regardless of the amount of tokens in the pool.

Holders of YOU tokens can earn passive income by putting them into the staking pool to earn a share of the platform profits.

Farm

Users can provide liquidity on the Swap feature and collect YOU token rewards.

The youves platform also contains a swap feature to allow for on-chain exchange for a number of tokens on the Tezos blockchain.

YouvesYour tool on Tezos for asset creation and management. Decentralised, Non-Custodial, Self governed.

Submit your Tezos project to XTZ.news to have your project featured on the website. We only allow projects to be submitted that are presently interacting with the Tezos ecosystem.

Submit a ProjectKolibri 是一种基于 Tezos 的稳定币,它使用抵押债务头寸 (CDP),称为“烤箱”,来维持与美元稳定价值资产 kUSD 的软挂钩。

下一代Tezos DEX聚合器。 在一次掉期中来自最流行的 Tezos DEX 的流动性。 最优惠的价格和低滑点。 由 Baking Bad 打造。

Crunchy Network 代表了 Tezos DeFi 的一站式解决方案,并拥有一整套可用的 DeFi 应用程序和功能,包括 Crnchy 代币、Tezos 代币跟踪器、DeFi 钱包、流动性挖矿、DEX 聚合、Deep freezers(流动性储物柜)和未来的 sliced.art 平台。