콜리브리

콜리브리(Kolibri)는 테조스(Tezos) 기반의 스테이블코인으로, ‘오븐(Ovens)’이라고 불리는 부채담보부증권(CDP)을 사용하여 소프트 페깅된 USD 안정 가치 자산인 kUSD를 유지합니다.

콜리브리(Kolibri)는 테조스(Tezos) 기반의 스테이블코인으로, ‘오븐(Ovens)’이라고 불리는 부채담보부증권(CDP)을 사용하여 소프트 페깅된 USD 안정 가치 자산인 kUSD를 유지합니다.

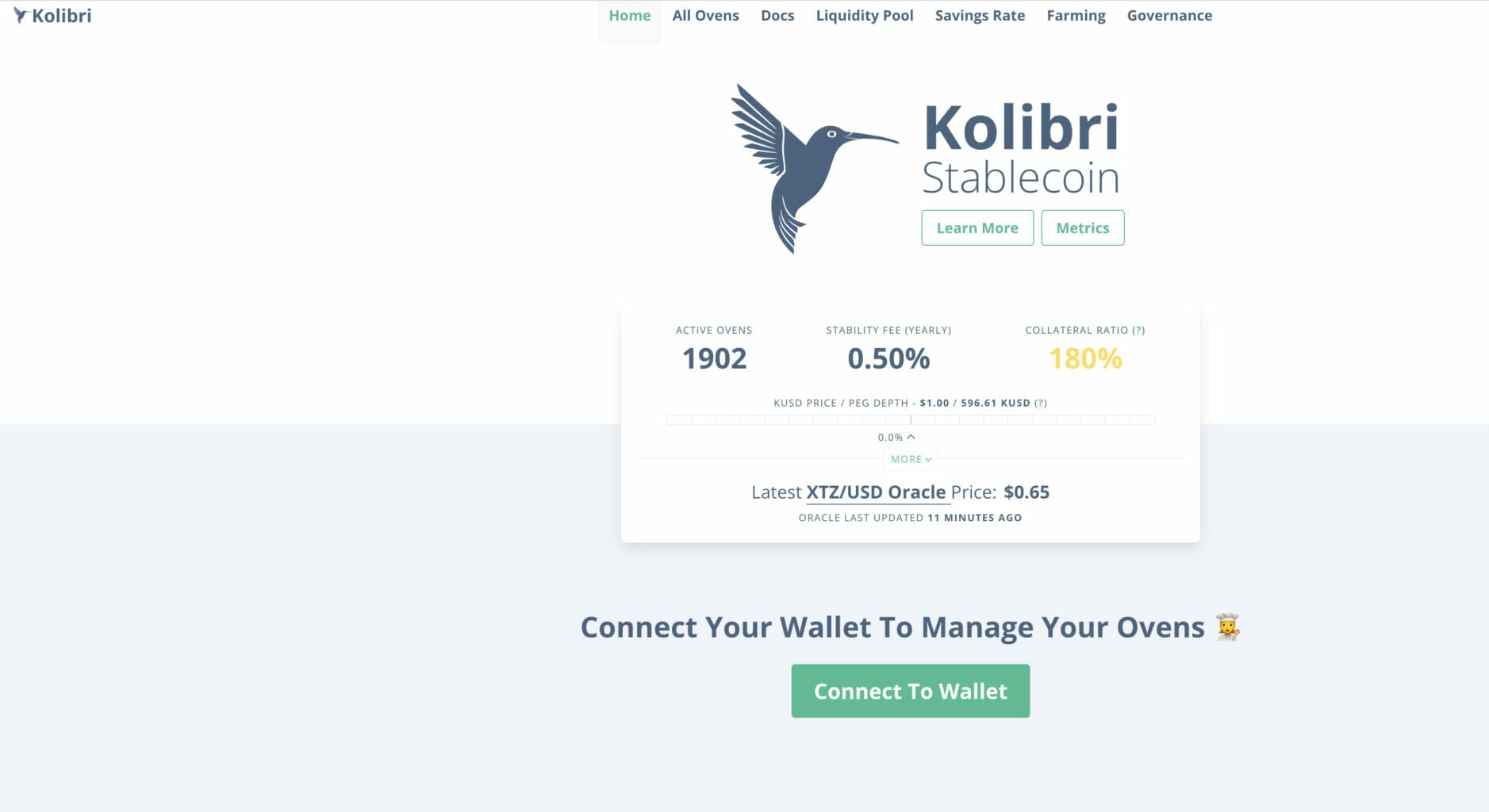

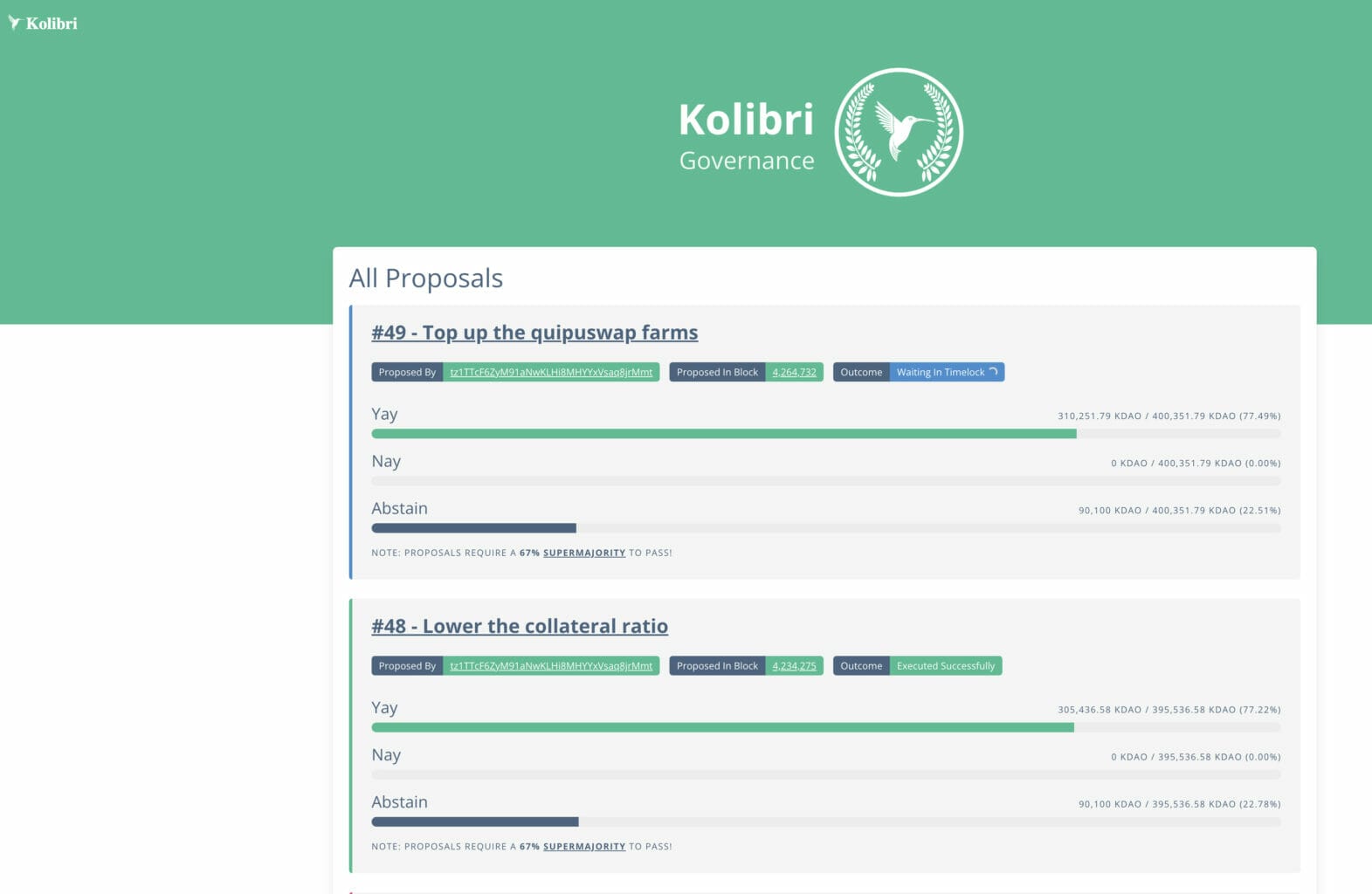

Kolibri is a Tezos-based stablecoin that uses Collateralized Debt Positions (CDPs), referred to as “Ovens,” to maintain a soft-pegged USD-stable value asset, kUSD. Users can deposit XTZ into an Oven and borrow kUSD against it, while also having the ability to withdraw or repay at any time. The system calculates a stability fee on borrowed kUSD, which is adjusted via governance to influence borrowing and repayment behaviors. To ensure solvency, each Oven must maintain a minimum collateralization ratio, which is rigorously calculated based on the XTZ deposited, the price of XTZ/USD, borrowed kUSD, and the stability fees accrued. In cases where an Oven falls below the collateralization ratio, a liquidation process is initiated to restore stability to the system.

Kolibri maintains a constant called the stability fee, calculated on a 60-second basis, and utilizes a linear approximation for interest calculation. The project operates with an Interest Index for each Oven, which is used to determine the interest each Oven has accrued, ensuring a seamless calculation process even in a system like Tezos. This Interest Index is adjusted with every interaction with the Minter, ensuring an up-to-date and accurate reflection of the interest accrued. The system receives accurate data from the Harbinger Price Feed via an Oracle contract, which can be replaced if needed, ensuring the flexibility and reliability of the data used for calculations.

In order to handle exceptional situations, Kolibri has established stability and developer funds. The stability fund acts as a liquidator of last resort, ensuring that the system can restore collateralization even in the event of a significant downturn, while the developer fund is used to finance future developments of Kolibri. The project is also dedicated to maintaining the peg of the kUSD token, with economic policies in place to ensure that 1 kUSD remains roughly equal to $1, providing a stable and reliable digital asset in the fluctuating cryptocurrency market.

Kolibri

Kolibri is a Tezos-based stablecoin leveraging Collateralized Debt Positions (CDPs), known as Ovens, to uphold a soft-pegged USD-stable asset, kUSD. Utilizing the Harbinger Price Feed, users can deposit or withdraw XTZ, borrow kUSD, and repay their borrowed amount. Each Oven must maintain a minimum collateralization ratio to remain solvent, preventing users from borrowing excessive kUSD and ensuring system stability. The stability fee, adjusted via governance, is applied to borrowed kUSD, helping in maintaining the peg to the USD. In case of under collateralization, a liquidation process is triggered to reinstate system stability. The project aims to sustain a consistent value for kUSD, equivalent to one USD, while automatically accounting for XTZ price fluctuations.

Key Features:

Oven Functions:

Deposit and withdraw XTZ.

Borrow and repay kUSD.

Stability Fee:

Accrued in kUSD terms.

Assessed every minute.

Adjusted via governance for incentive balance.

Collateralization Ratio:

Essential for Oven solvency.

Governed by XTZ value, borrowed kUSD, and stability fees.

Interest Calculation:

Linear approximation used.

Global and individual Oven interest indices maintained.

Oracle Contract:

Utilizes Harbinger Price Feed.

Ensures accurate and reliable data for operation.

Funds:

Stability and developer funds for system and future development support.

The Peg:

Aims for 1 kUSD to always equal $1.

Self-correcting mechanism for underlying XTZ price fluctuations.

Peg Depth:

Provides market liquidity insight.

Additional Information:

Kolibri also incorporates an Interest Index, updated with every interaction with the Minter, ensuring accurate interest calculation. The developer and stability funds help in mitigating risks and funding future developments, while the Oracle contract guarantees precise data for transactions and stability fee adjustments. Furthermore, the system continuously strives to keep the kUSD value at par with $1, employing various economic strategies to offset market variables and sustain the “soft peg.” The Harbinger Price Feed further fortifies the system’s reliability, inspired by Compound’s Open Price Feed, offering signed, dependable price data for seamless operations.

Kolibri is made by Hover Labs. Creator of decentralized products, infrastructure and services.

Submit your Tezos project to XTZ.news to have your project featured on the website. We only allow projects to be submitted that are presently interacting with the Tezos ecosystem.

Submit a Project자산 생성 및 관리를 위한 Tezos의 도구입니다. 탈중앙화, 비수탁형, 자치.

차세대 Tezos DEX 애그리게이터. 가장 인기 있는 Tezos DEX의 유동성을 한 번의 스왑으로 제공합니다. 최고의 가격과 낮은 슬리피지. Baking Bad에서 제작했습니다.

Crunchy Network는 Tezos DeFi의 원스톱 쇼핑 솔루션을 나타내며 Crnchy 토큰, Tezos 토큰 추적기, DeFi 지갑, 이자 농사, DEX 집계, 딥 프리저(유동성 보관함) 및 미래 sliced.art 플랫폼을 포함하여 사용 가능한 전체 DeFi 애플리케이션 및 기능 제품군을 보유하고 있습니다.