유베스

자산 생성 및 관리를 위한 Tezos의 도구입니다. 탈중앙화, 비수탁형, 자치.

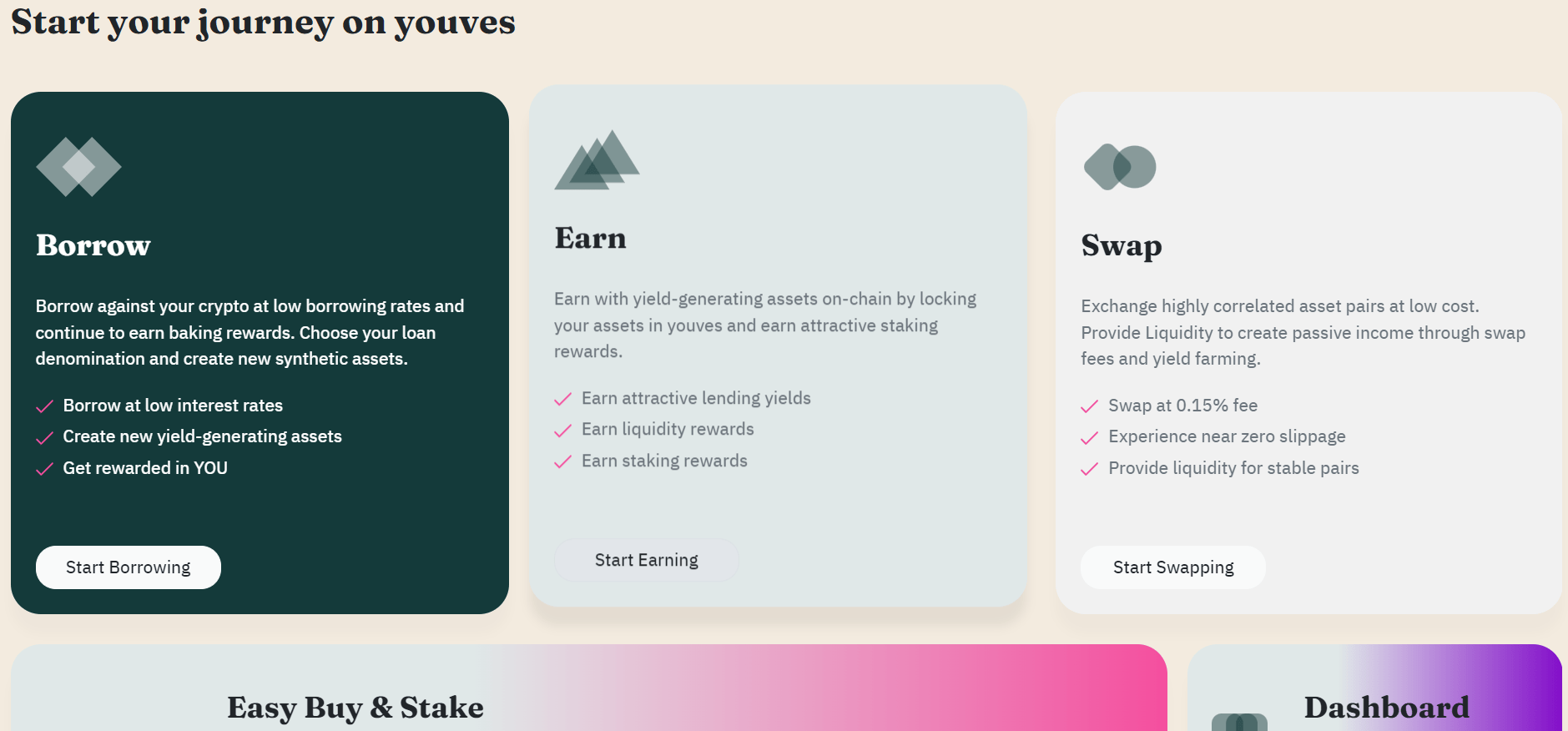

Borrow, Earn or Swap on youves.

Borrow against your crypto at low borrowing rates and continue to earn

free YOU tokens as incentives for minting and also get baking rewards

on your tez collateral. Choose your loan denomination and create new

synthetic assets like uUSD or uBTC or uXTZ or uXAU.

Earn with yield-generating assets on-chain. Lock your assets in the

youves pools and earn yields from platform revenues.

Swap highly correlated asset pairs at low slippage. Provide liquidity to

create passive income through swap fees and yield farming.

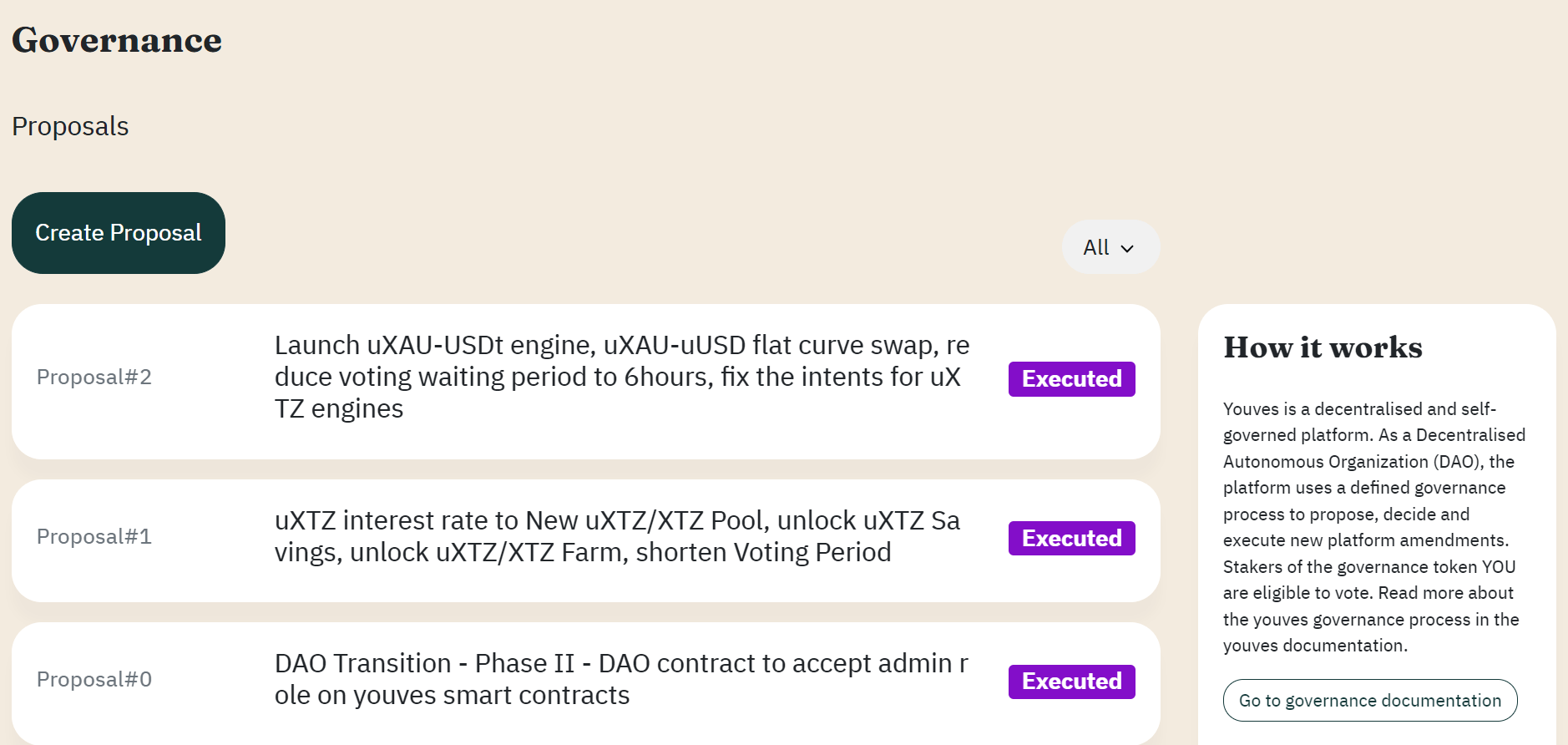

GOVERNANCE:

Make your voice heard by actively participating in the youves DAO

proposals and voting on YIPs.

Borrow (Mint):

With the collateralized lending mechanism on youves, users can create (mint) the stable token uUSD by locking up crypto collateral.

Minted tokens can be sold against other cryptocurrencies and/or fiat currencies to either create leverage or a fiat loan respectively.

There is a liability interest rate applied to the outstanding amount.

To withdraw the full amount of the provided collateral, minters have to burn (pay back) the minted amount plus any accrued interest.

The minimum collateral level (or maximum LTV) depends on the collateral type.

Minters must make sure the collateral level never falls below the minimum level, otherwise they risk being liquidated.

Minters are incentivised with YOU governance tokens.

Earn – Save & Stake

Holders of uUSD can diversify their crypto-asset exposure without having to access FIAT directly.

Holders of uUSD can earn an interest rate (paid by the minters) by putting them into the savings pool.

The entirety of liability interest rates minus the platform profit of 1% is distributed to the savings pool, regardless of the amount of tokens in the pool.

Holders of YOU tokens can earn passive income by putting them into the staking pool to earn a share of the platform profits.

Farm

Users can provide liquidity on the Swap feature and collect YOU token rewards.

The youves platform also contains a swap feature to allow for on-chain exchange for a number of tokens on the Tezos blockchain.

YouvesYour tool on Tezos for asset creation and management. Decentralised, Non-Custodial, Self governed.

Submit your Tezos project to XTZ.news to have your project featured on the website. We only allow projects to be submitted that are presently interacting with the Tezos ecosystem.

Submit a Project콜리브리(Kolibri)는 테조스(Tezos) 기반의 스테이블코인으로, ‘오븐(Ovens)’이라고 불리는 부채담보부증권(CDP)을 사용하여 소프트 페깅된 USD 안정 가치 자산인 kUSD를 유지합니다.

차세대 Tezos DEX 애그리게이터. 가장 인기 있는 Tezos DEX의 유동성을 한 번의 스왑으로 제공합니다. 최고의 가격과 낮은 슬리피지. Baking Bad에서 제작했습니다.

Crunchy Network는 Tezos DeFi의 원스톱 쇼핑 솔루션을 나타내며 Crnchy 토큰, Tezos 토큰 추적기, DeFi 지갑, 이자 농사, DEX 집계, 딥 프리저(유동성 보관함) 및 미래 sliced.art 플랫폼을 포함하여 사용 가능한 전체 DeFi 애플리케이션 및 기능 제품군을 보유하고 있습니다.