ユーブス

資産の作成と管理のためのTezos上のツール。分散型、非カストディアル、自治。

資産の作成と管理のためのTezos上のツール。分散型、非カストディアル、自治。

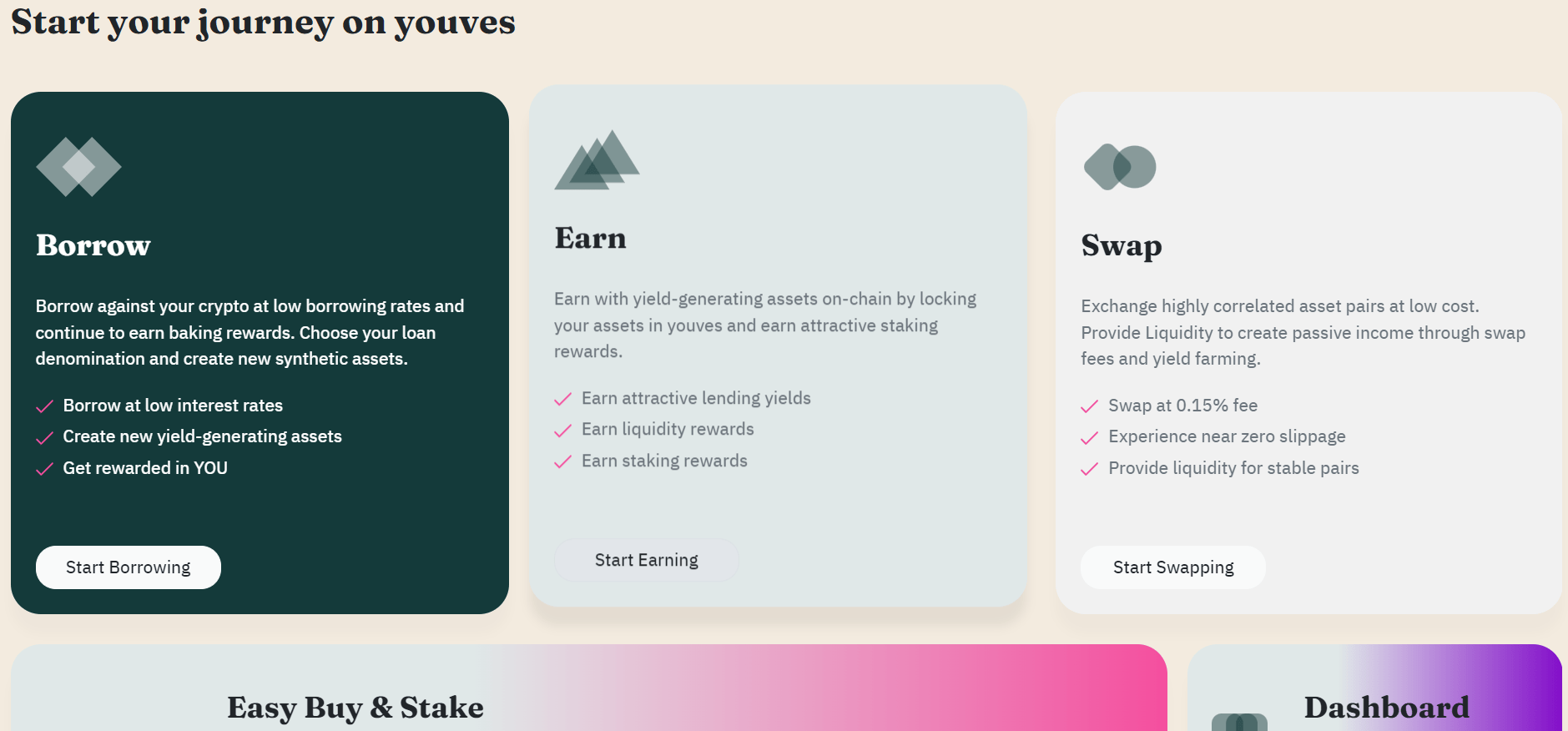

Borrow, Earn or Swap on youves.

Borrow against your crypto at low borrowing rates and continue to earn

free YOU tokens as incentives for minting and also get baking rewards

on your tez collateral. Choose your loan denomination and create new

synthetic assets like uUSD or uBTC or uXTZ or uXAU.

Earn with yield-generating assets on-chain. Lock your assets in the

youves pools and earn yields from platform revenues.

Swap highly correlated asset pairs at low slippage. Provide liquidity to

create passive income through swap fees and yield farming.

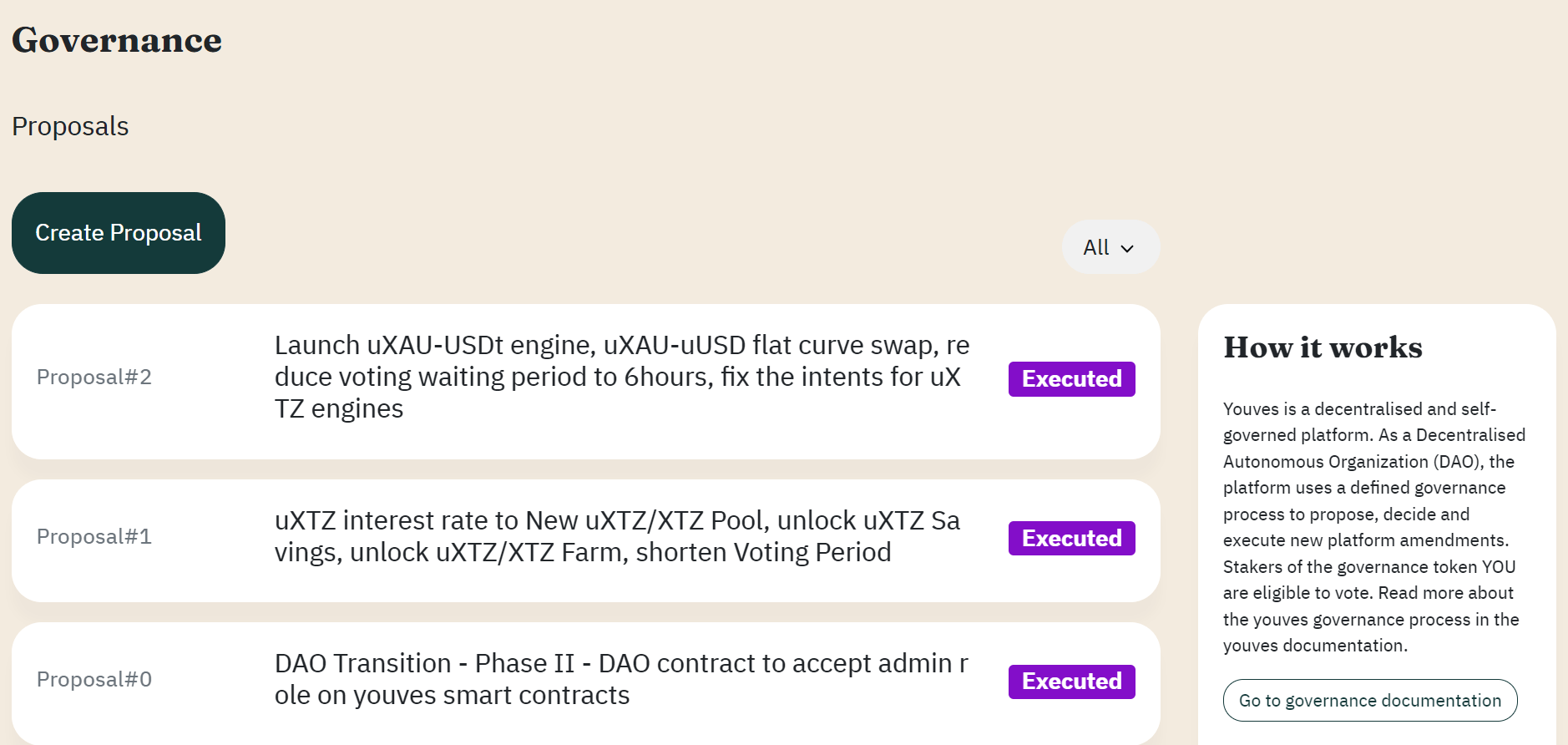

GOVERNANCE:

Make your voice heard by actively participating in the youves DAO

proposals and voting on YIPs.

Borrow (Mint):

With the collateralized lending mechanism on youves, users can create (mint) the stable token uUSD by locking up crypto collateral.

Minted tokens can be sold against other cryptocurrencies and/or fiat currencies to either create leverage or a fiat loan respectively.

There is a liability interest rate applied to the outstanding amount.

To withdraw the full amount of the provided collateral, minters have to burn (pay back) the minted amount plus any accrued interest.

The minimum collateral level (or maximum LTV) depends on the collateral type.

Minters must make sure the collateral level never falls below the minimum level, otherwise they risk being liquidated.

Minters are incentivised with YOU governance tokens.

Earn – Save & Stake

Holders of uUSD can diversify their crypto-asset exposure without having to access FIAT directly.

Holders of uUSD can earn an interest rate (paid by the minters) by putting them into the savings pool.

The entirety of liability interest rates minus the platform profit of 1% is distributed to the savings pool, regardless of the amount of tokens in the pool.

Holders of YOU tokens can earn passive income by putting them into the staking pool to earn a share of the platform profits.

Farm

Users can provide liquidity on the Swap feature and collect YOU token rewards.

The youves platform also contains a swap feature to allow for on-chain exchange for a number of tokens on the Tezos blockchain.

YouvesYour tool on Tezos for asset creation and management. Decentralised, Non-Custodial, Self governed.

Submit your Tezos project to XTZ.news to have your project featured on the website. We only allow projects to be submitted that are presently interacting with the Tezos ecosystem.

Submit a ProjectKolibriはTezosベースのステーブルコインで、「オーブン」と呼ばれるCDP(担保付債務ポジション)を使用して、ソフトペッグされた米ドルで安定した価値資産kUSDを維持しています。

次世代のTezos DEXアグリゲーター。 最も人気のあるTezos DEXの流動性を1回のスワップで。 最高の価格と低いスリッページ。 Baking Badによって構築されました。

Crunchy Networkは、Tezos DeFiのワンストップショップソリューションであり、Crnchyトークン、Tezos Token Tracker、DeFiウォレット、イールドファーミング、DEXアグリゲート、ディープフリーザー(流動性ロッカー)、将来の sliced.art プラットフォームなど、DeFiアプリケーションと機能のスイート全体を利用できます。