Youves

Your tool on Tezos for asset creation and management.Decentralised, Non-Custodial, Self governed.

Your tool on Tezos for asset creation and management.Decentralised, Non-Custodial, Self governed.

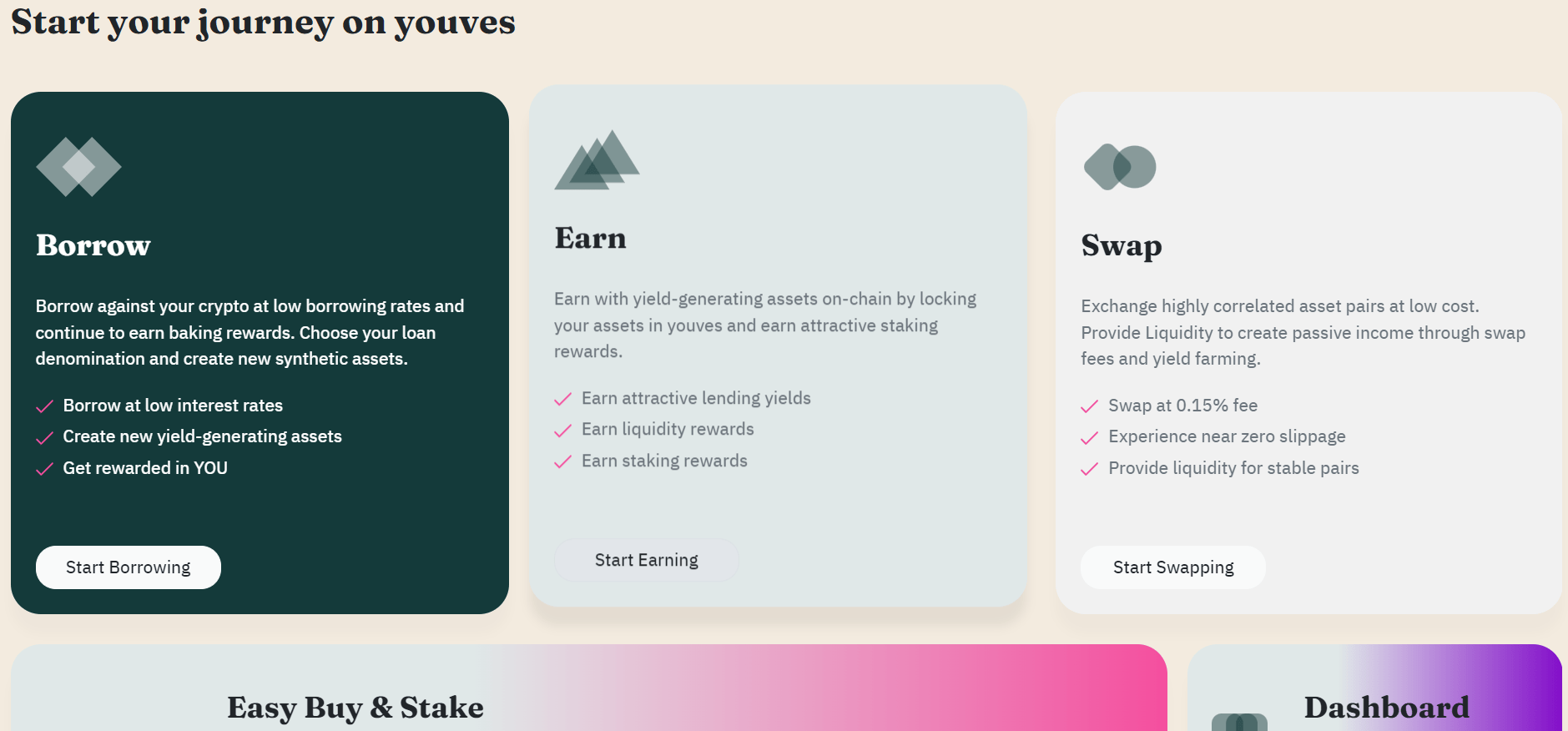

Borrow, Earn or Swap on youves.

Borrow against your crypto at low borrowing rates and continue to earn

free YOU tokens as incentives for minting and also get baking rewards

on your tez collateral. Choose your loan denomination and create new

synthetic assets like uUSD or uBTC or uXTZ or uXAU.

Earn with yield-generating assets on-chain. Lock your assets in the

youves pools and earn yields from platform revenues.

Swap highly correlated asset pairs at low slippage. Provide liquidity to

create passive income through swap fees and yield farming.

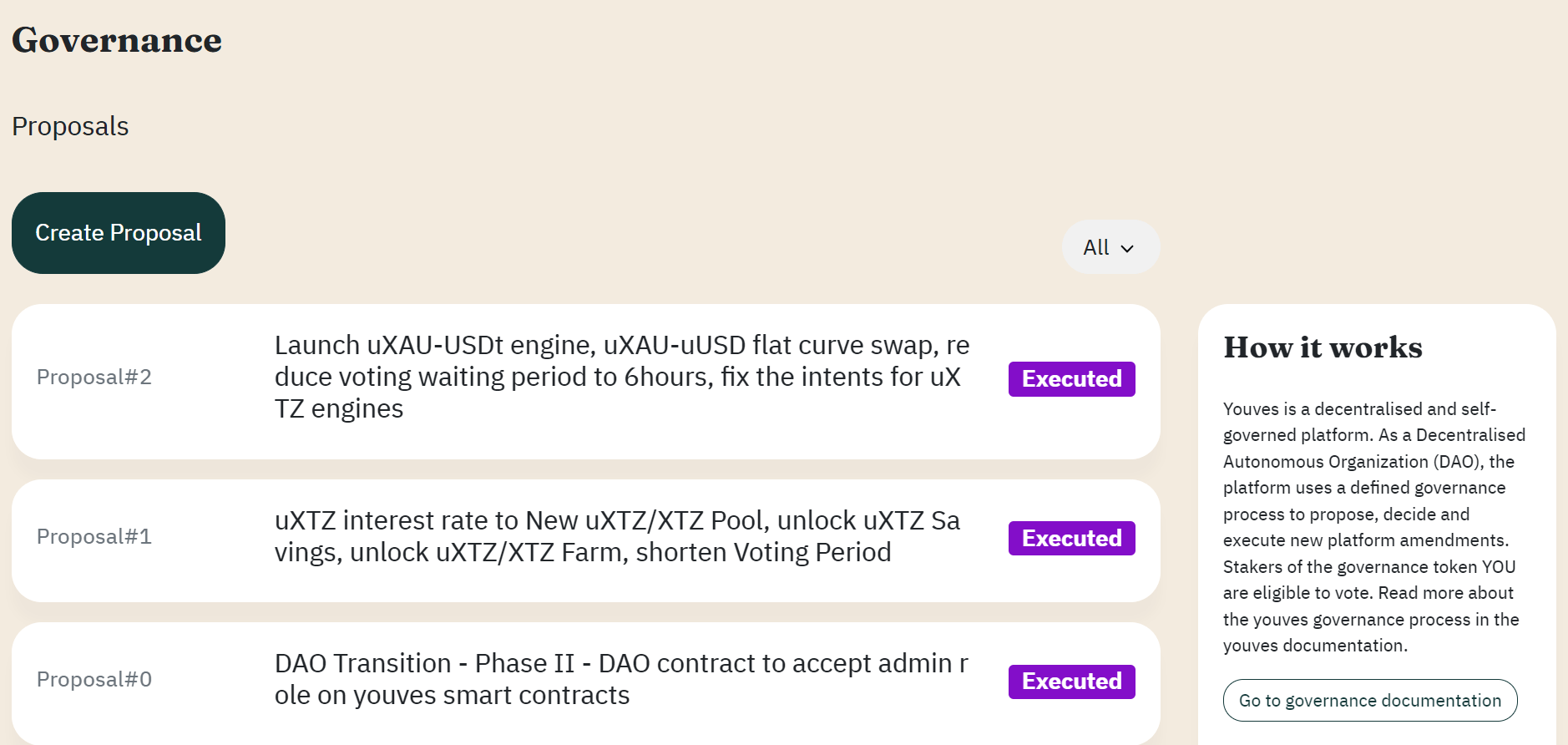

GOVERNANCE:

Make your voice heard by actively participating in the youves DAO

proposals and voting on YIPs.

Borrow (Mint):

With the collateralized lending mechanism on youves, users can create (mint) the stable token uUSD by locking up crypto collateral.

Minted tokens can be sold against other cryptocurrencies and/or fiat currencies to either create leverage or a fiat loan respectively.

There is a liability interest rate applied to the outstanding amount.

To withdraw the full amount of the provided collateral, minters have to burn (pay back) the minted amount plus any accrued interest.

The minimum collateral level (or maximum LTV) depends on the collateral type.

Minters must make sure the collateral level never falls below the minimum level, otherwise they risk being liquidated.

Minters are incentivised with YOU governance tokens.

Earn – Save & Stake

Holders of uUSD can diversify their crypto-asset exposure without having to access FIAT directly.

Holders of uUSD can earn an interest rate (paid by the minters) by putting them into the savings pool.

The entirety of liability interest rates minus the platform profit of 1% is distributed to the savings pool, regardless of the amount of tokens in the pool.

Holders of YOU tokens can earn passive income by putting them into the staking pool to earn a share of the platform profits.

Farm

Users can provide liquidity on the Swap feature and collect YOU token rewards.

The youves platform also contains a swap feature to allow for on-chain exchange for a number of tokens on the Tezos blockchain.

YouvesYour tool on Tezos for asset creation and management. Decentralised, Non-Custodial, Self governed.

uXAU is a synthetic token, which means that the value of gold is tracked by the token and the token itself is not backed by any actual gold. The value is backed by other collateral, in this case Tezos-based Tether (USDt). USDT is tethered to the US dollar, the idea in theory being that you can trade 1 Tether for 1 US dollar, regardless of market conditions.

Swiss banking group Swissquote, Switzerland’s leading regulated bank for online trading services has launched Tezos staking.

The DEX function will be available on the youves DeFi platform and especially aims to enable close to 1:1 trades for BTC wrapped tokens and stable coins.

These tokens aim for a 1:1 value and should be tradeable as such, 1 tzBTC should be valued as 1 BTC and 1 uBTC should be valued as 1 BTC, which means the tzBTC and uBTC should be tradeable 1 for 1.

Submit your Tezos project to XTZ.news to have your project featured on the website. We only allow projects to be submitted that are presently interacting with the Tezos ecosystem.

Submit a ProjectKolibri is a Tezos-based stablecoin that uses Collateralized Debt Positions (CDPs), referred to as “Ovens,” to maintain a soft-pegged USD-stable value asset, kUSD.

The Next Gen Tezos DEX Aggregator. Liquidity from most popular Tezos DEXes in one swap. Best prices and low slippage. Built by Baking Bad.

The Crunchy Network represent a one-stop-shop solution in Tezos DeFi and have a whole suite of DeFi applications and features available including the Crnchy token, the Tezos Token Tracker, a DeFi wallet, yield farming, a DEX aggregate, Deep freezers (liquidity lockers) and the future sliced.art platform.